Planning Consultant

We provide expert planning consultation for loan settlement strategies.

We provide expert planning consultation for loan settlement strategies.

Clearing outstanding loans can free up working capital to reinvest in your business.

Our professional loan consultants are skilled negotiators with deep knowledge of financial regulations.

Loan settlement can significantly reduce your debt burden. We aim to negotiate a reduced payoff amount.

Settle Mitra is a dynamic fintech startup dedicated to providing effective Loan Settlement and Debt Relief solutions. Founded with the vision to assist individuals struggling with overwhelming financial burdens, Settle Mitra offers innovative strategies to help clients break free from the cycle of debt. Our expert consultants work closely with borrowers, negotiating with banks and financial institutions to secure favorable settlement terms — ensuring a clear path toward financial stability.

Read More

Settling a personal loan means reaching an agreement with the lender to pay a lump sum that is less than the total outstanding amount

Learn More

Credit card loan settlement involves negotiating with the bank to pay a reduced amount as a one-time settlement

Learn More

Anti-harassment services provide support and legal assistance to individuals facing physical, verbal, or cyber harassment

Learn More

Vehicle loan settlement involves negotiating with the lender to pay a reduced lump-sum amount to close the loan

Learn More

Business loan settlement is a process where the borrower negotiates with the lender to pay a reduced amount as a final settlement

Learn More

Education loan settlement involves negotiating with the lender to accept a lower lump-sum payment to close the loan

Learn More

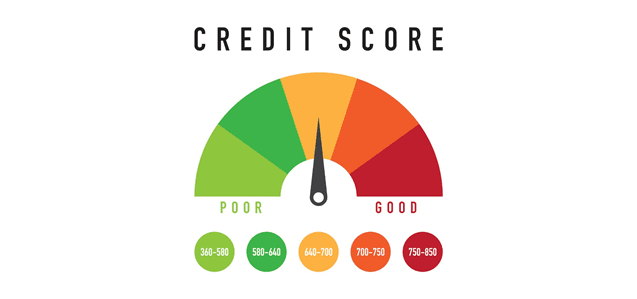

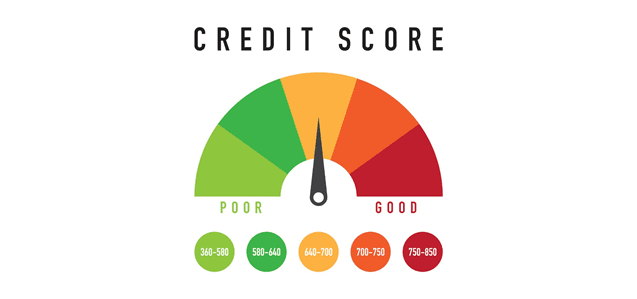

A credit score builder helps individuals improve their credit score through responsible financial practices such as timely payments, reducing debt

Learn More

Settling a personal loan means reaching an agreement with the lender to pay a lump sum that is less than the total outstanding amount

Learn More

Credit card loan settlement involves negotiating with the bank to pay a reduced amount as a one-time settlement

Learn More

Anti-harassment services provide support and legal assistance to individuals facing physical, verbal, or cyber harassment

Learn More

Vehicle loan settlement involves negotiating with the lender to pay a reduced lump-sum amount to close the loan

Learn More

Business loan settlement is a process where the borrower negotiates with the lender to pay a reduced amount as a final settlement

Learn More

Education loan settlement involves negotiating with the lender to accept a lower lump-sum payment to close the loan

Learn More

A credit score builder helps individuals improve their credit score through responsible financial practices such as timely payments, reducing debt

Learn MoreWith over 15 years in the industry and a 95% success rate, we have consistently delivered exceptional results for our clients.

Our team consists of certified debt specialists, experienced negotiators, and licensed attorneys dedicated to your success.

We provide full legal protection throughout your debt settlement journey, ensuring your rights are protected at every step.

We’re committed to providing accessible, results-driven debt relief at a fraction of typical industry costs.

Our proven negotiation strategies consistently achieve significant debt reductions, saving our clients thousands of dollars.

Round-the-clock support with dedicated account managers who guide you through every step of the process.

Every client receives a customized debt settlement strategy based on their unique financial situation, debt types, and personal goals.

Learn More

We leverage extensive market data and creditor behavior patterns to maximize settlement success rates and minimize settlement amounts.

Learn More

Our comprehensive legal strategy ensures full protection of your rights while maximizing settlement opportunities through expert legal guidance.

Learn More

We coordinate with all parties involved in your debt settlement to ensure seamless communication and optimal outcomes for everyone.

Learn More

Our financial strategy focuses on maximizing your savings while ensuring sustainable payment plans that fit your budget and lifestyle.

Learn More

Meticulous documentation and compliance strategies ensure all settlements are legally binding and properly executed for your protection.

Learn More

Strategic timing and sequencing of settlements to maximize results while minimizing the overall program duration and financial impact.

Learn More

Our proven methodologies and best practices ensure the highest possible success rates and optimal settlement outcomes for every client.

Learn More"Settle Mitra pulled me out of a debt crisis I thought was hopeless. As a small business owner in Delhi, I was drowning in unsecured loans. Their team negotiated a 60% reduction and structured a repayment plan I could actually manage. Their patience and expertise gave me a second chance."

"After my father’s sudden hospitalization, we owed over ₹20 lakhs in medical bills. Settle Mitra stepped in and reduced the debt by 65%. Their team handled everything with such care—I didn’t have to face a single aggressive collector. They’re not just professionals; they’re lifesavers."

"I was hours away from filing bankruptcy due to my education loan. Settle Mitra intervened, negotiated with the bank, and cut my debt by 50%. What amazed me most was their transparency—they explained every document and kept me involved in every decision."

"As a farmer in Punjab, my crop failure led to crushing debt. Settle Mitra’s rural debt relief program was a godsend. They reduced my liabilities by 60% and even connected me with government subsidies. Their team treated me with dignity, not judgment."

"I tried settling my home loan arrears alone for years but got nowhere. Settle Mitra took over, secured a 58% settlement, and stopped the foreclosure notice. Their legal team was relentless—they fought for me like family."

"Running a startup in Bangalore is tough when creditors are breathing down your neck. Settle Mitra’s business restructuring plan saved my company. They renegotiated terms, reduced interest rates, and even helped me secure fresh funding. True partners in crisis."

"My husband’s job loss left us with unpaid credit card bills. Settle Mitra negotiated a 62% reduction and waived all penalties. Their counselors were empathetic—they never made me feel ashamed of my situation."

"I was scammed by a fake debt settlement agency before finding Settle Mitra. They restored my trust—no hidden fees, no false promises. Just honest work. They settled my ₹15 lakh debt for ₹6 lakh, and the process was smoother than I ever imagined."

"As a widow in Kolkata, I couldn’t handle my late husband’s loan demands. Settle Mitra took charge, reduced the debt by 70%, and ensured I kept my home. Their team’s compassion and strength carried me through the darkest time."

"Settle Mitra didn’t just settle my debt—they rebuilt my financial confidence. After a failed partnership left me owing ₹8 lakh, they negotiated a 53% settlement and even guided me on rebuilding my credit. Truly life-changing."

0

+0

(In Crores)0

%If you need to speak to us about a general query fill in

the form below and we will call you back within the

same working day.